Understanding Validators and Staking

You’ve probably wondered how or if the blockchain is secured. Well it is, and it’s all thanks to Validators. They verify the correctness of transactions or blocks before they are added to the chain.

Now, what if I told you that you can indirectly play a role in this system—and earn rewards? What I like to call making your money work for you. :-P

In this article, I'll break down:

The roles of validators in blockchain,

How to choose and stake with a validator,

The pros and cons of staking, why you should (or shouldn’t) consider it.

By the end, I hope you’ll have a clear understanding of what validators and staking means, and you’re able to make very informed decisions. So, let’s dive in!

First things first, what are validators?

In blockchain, validators play a vital role in ensuring the integrity and security of the network. But what exactly do they do, and how do they contribute to the functioning of a Proof-of-Stake (PoS) blockchain like Solana?

Validators perform several critical tasks:

Verify Transactions: They check the validity of transactions within the network, ensuring that all transactions are legitimate and follow the rules.

Propose and Validate Blocks: Validators add new blocks to the blockchain and validate the proposals of other validators, maintaining the integrity of the chain.

Maintain Consensus: They work collectively to ensure that all participants in the network agree on the current state of the blockchain.

Secure the Network: By verifying and recording transactions, validators protect the blockchain from fraudulent activities and malicious attacks.

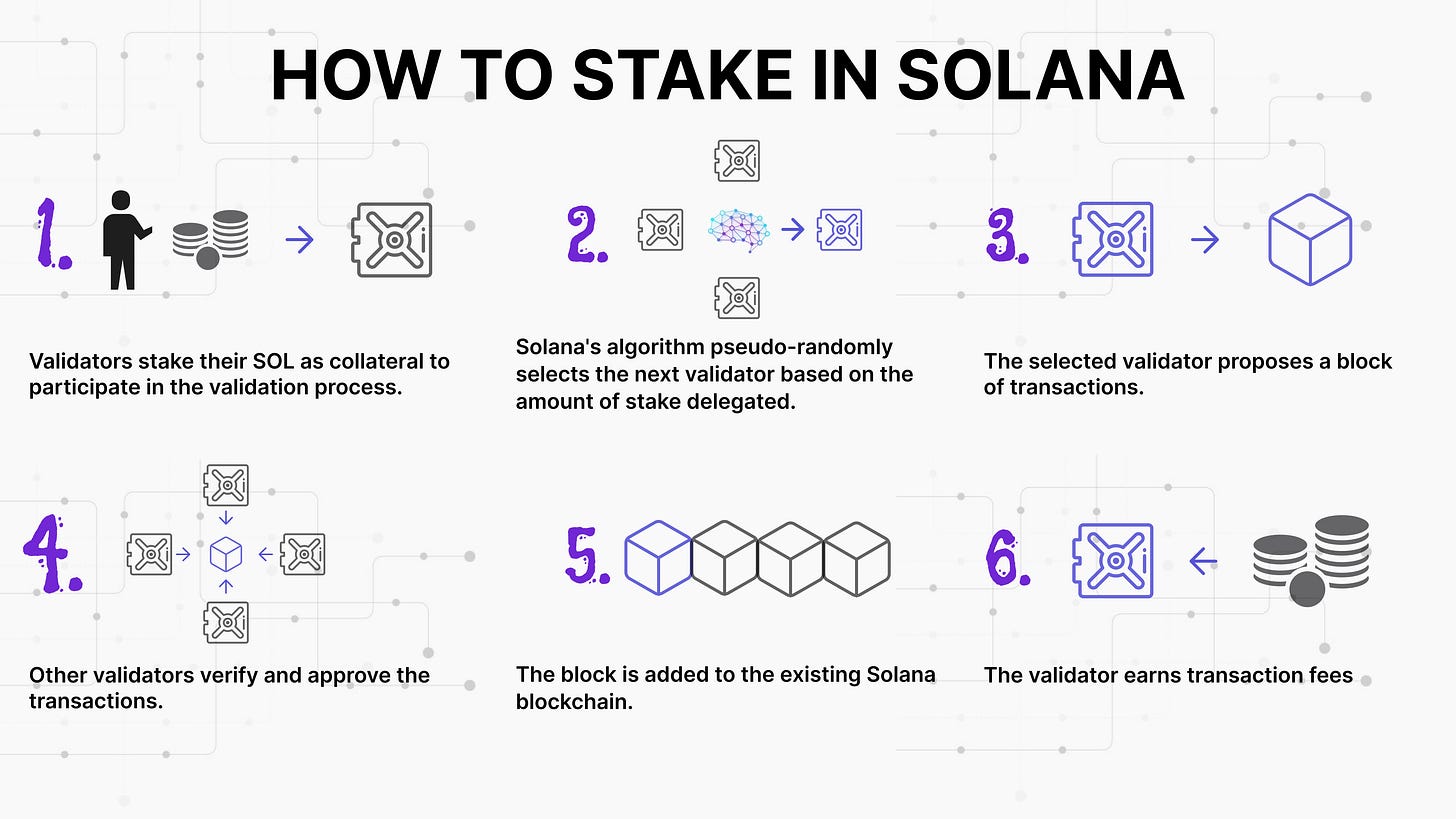

These tasks are crucial in supporting the Proof-of-Stake (PoS) consensus mechanism, which relies on validators "staking" their own tokens to participate in the validation process. By doing so, validators have a vested interest in maintaining the integrity and security of the network.

How validators earn revenue

As a reward for their efforts, validators earn revenue through several channels:

Transaction Fees: Validators earn a portion of the transaction fees paid by users for processing transactions on the network.

Commission from Delegators: Validators earn additional revenue by charging a commission to delegators who stake their tokens with them. I'll talk more on this topic later in the article.

Staking Rewards: Validators receive newly minted SOL tokens as staking rewards, distributed at the end of each epoch. The amount of SOL tokens rewarded is governed by Solana's inflation schedule.

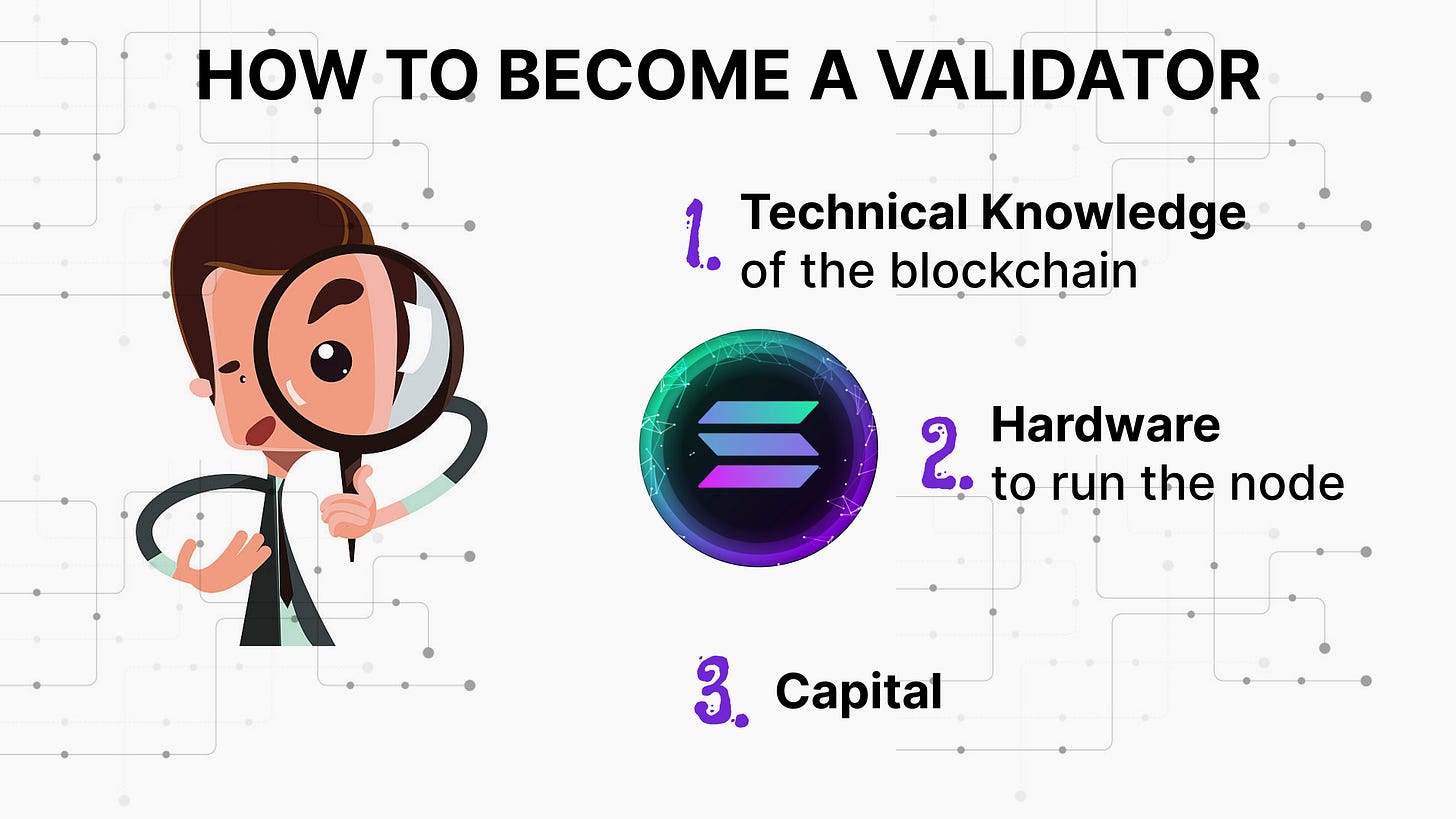

Now that you understand the crucial role validators play in the Solana blockchain, you might be thinking, 'How do I become a validator?'

Becoming a validator requires:

Technical Knowledge: A deep understanding of blockchain operations.

Hardware: High-performance computers and stable internet.

Capital: Funds for validator fees, server costs, and staking deposits.

For many, this can be a costly and demanding process. Thankfully, staking offers an easier way to participate. Let’s explore staking and how you can contribute and benefit from it.

WHAT IS STAKING

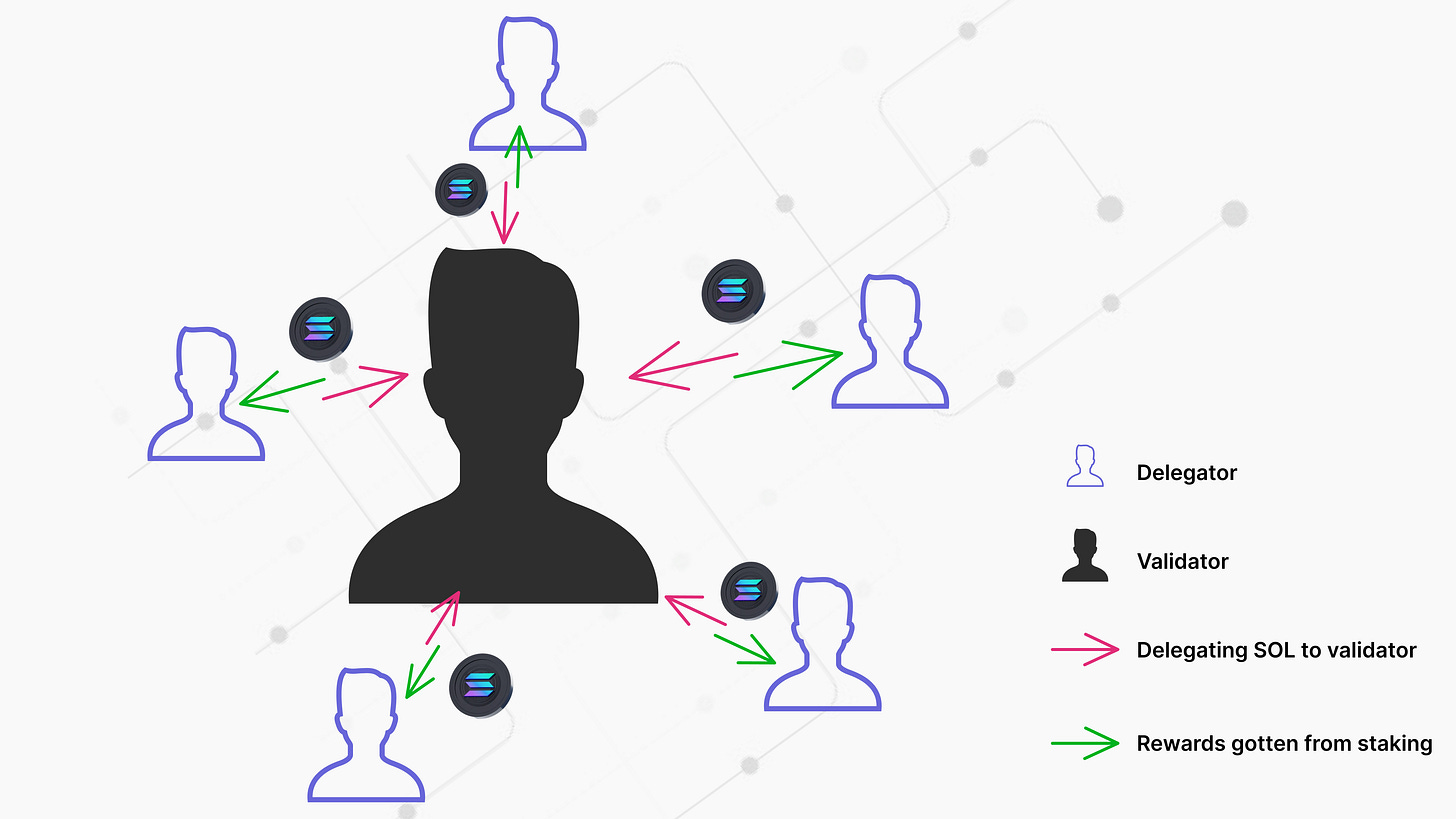

Staking involves delegating your SOL tokens to a validator you trust, effectively supporting their efforts to secure the network. By doing so, you become a delegator, contributing to the network operations without having to run your own node.

In return for supporting the network, you earn rewards based on the amount of SOL you’ve staked and the performance of your chosen validator.

STAKING OPTIONS

Once you've decided to stake your SOL, you have three main options:

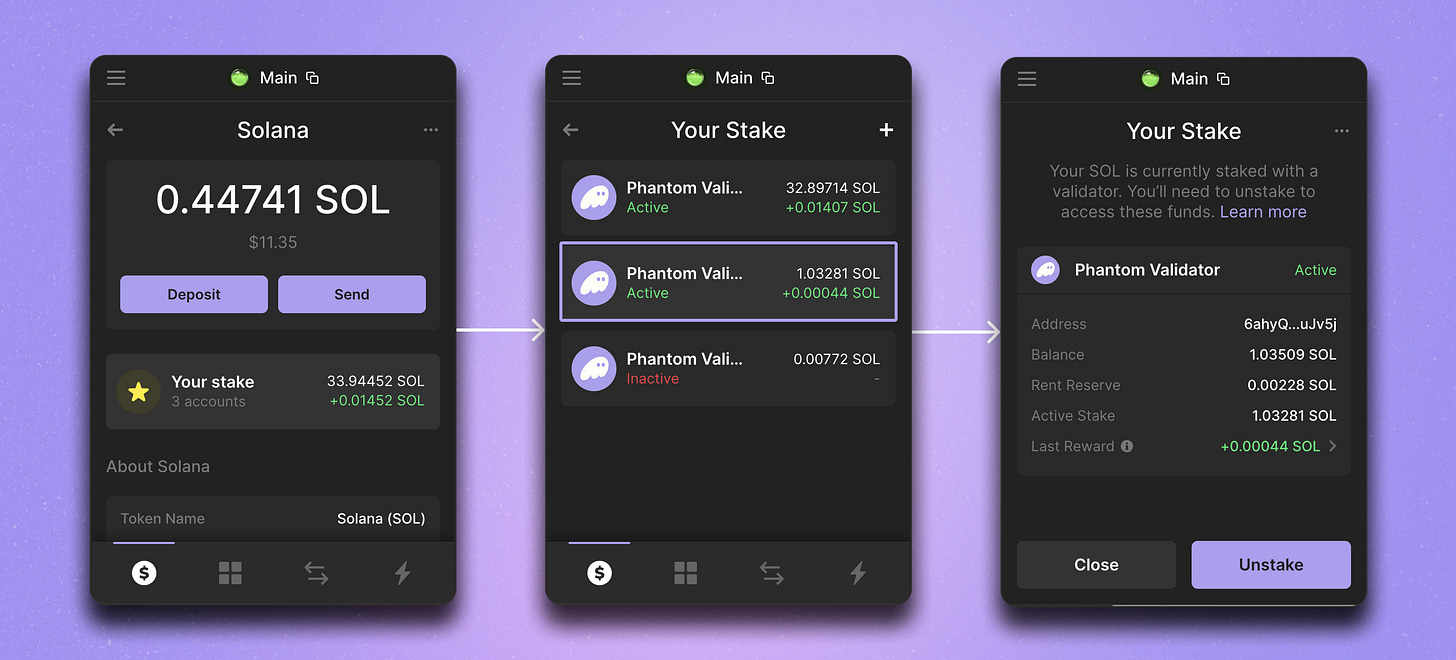

Direct Staking: Here, you delegate your SOL directly validator node using your wallet. This method gives you control over which validator you support and is the focus of this article.

Staking Pools and Services: Trusted third-party services will delegate your SOL to different validator nodes on your behalf.

Exchange-Based Staking: Some cryptocurrency exchanges offer staking services, providing a user-friendly interface to stake your SOL directly through their platform. However, this method comes with additional third-party risks.

How to Choose and Stake with a Validator

Now that you're ready to stake, it's essential to find the right validator. Not all validators are equal, and your earnings depend on their performance. Fortunately, Solana staking protects your stake, and any profits or losses come from your rewards, not your capital.

What to Consider When Choosing a Validator

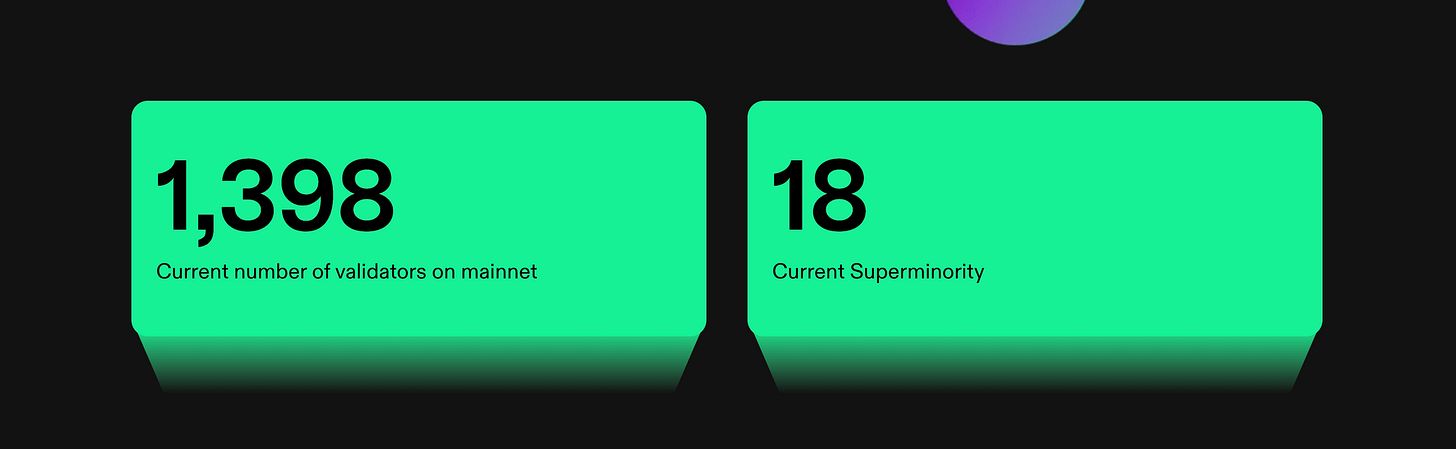

Validator Size and Concentration: Solana has 1,398 validators, with the top 18 controlling a super minority of the network. To support decentralization and network security, consider staking with smaller, dedicated validators who often offer competitive rewards

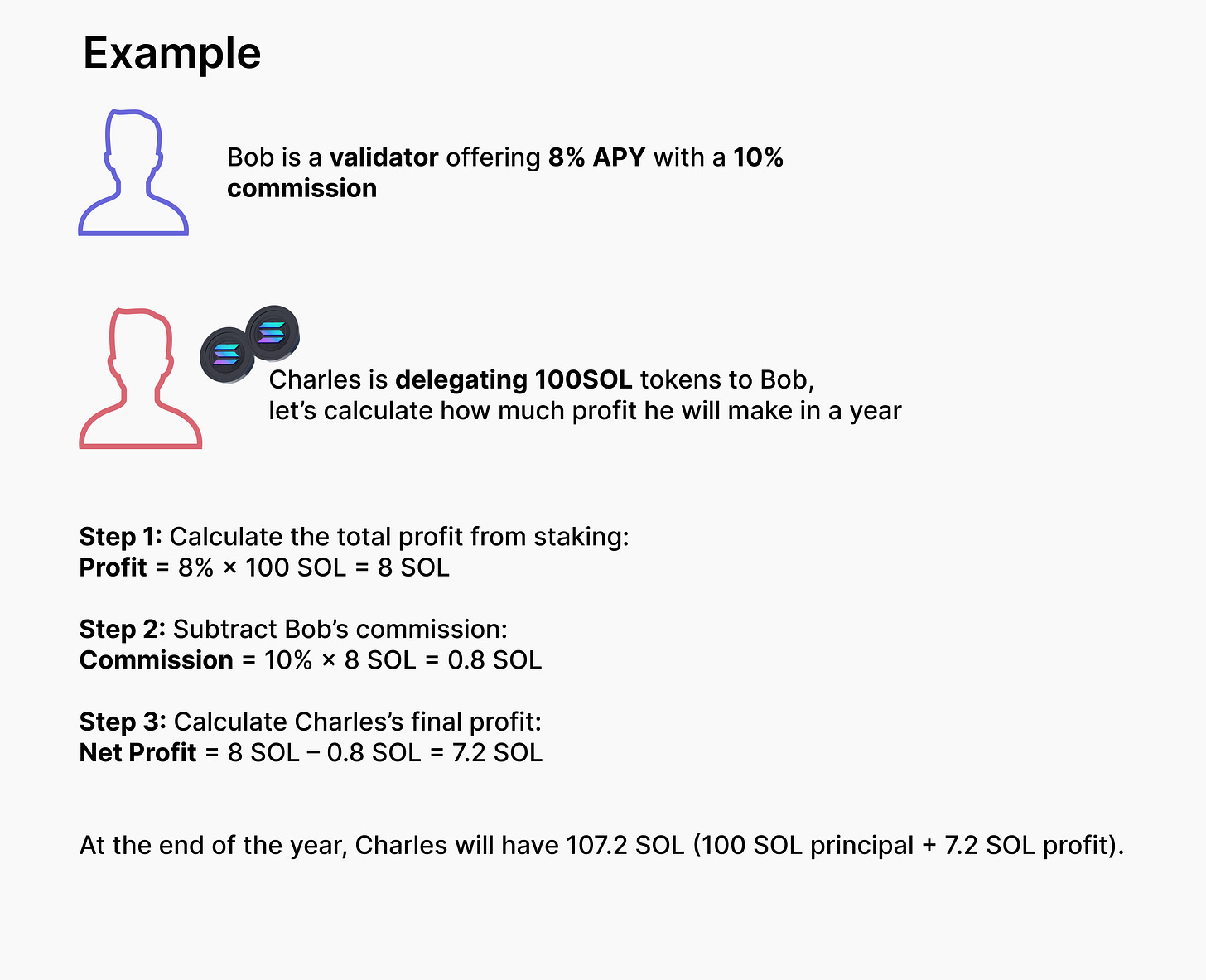

Validators and Superminority, gotten from Solana Understanding Commission Fees and APY: Validators charge a commission fee, which is a percentage of the rewards they keep as payment for running and maintaining their node. The rest of the rewards are distributed to delegators like you.

Commission Fee: Set by the validator, this fee typically ranges from 0% to over 10%.

Low Fees: May attract more delegators but don’t always guarantee better performance.

High Fees: Often charged by established validators with strong reputations and performance.

Red Flags: Avoid 100% commission validators (you’ll receive no rewards), and be cautious with permanently 0% fee validators, as they may not sustain operations long-term.

APY (Annual Percentage Yield): This is the yearly return on your staked SOL, including rewards and compounding. APY varies based on network performance, the validator's efficiency, and the overall staking pool.

Validator Performance: A validator's performance directly impacts your rewards. To ensure you earn consistently, consider the following key performance indicators:

Uptime: Look for validators with consistently high uptime (>99%) to minimize reward losses.

Vote Performance: Choose validators with minimal skipped votes (<1%) to ensure they're efficient and reliable.

Hardware Specifications: Opt for validators using powerful, optimized hardware to reduce downtime and missed votes.

Solana's voting mechanism rewards validators for participating in votes. If a validator fails to show up or is late, they won't receive rewards, affecting your earnings. By evaluating these metrics, you can assess a validator's reliability and make an informed decision.

Research and Evaluate Validator Credibility: Look for validators with strong community engagement on platforms like Reddit, Discord, or Twitter, a proven voting record, a professional website, and reliable contact methods. Avoid validators with poor online presence or lack of responsiveness.

Diversify Your Stake: You can delegate to more than one validator to spread your stake across multiple accounts. Note that you'll need to create a separate account for each new validator you want to delegate to. Diversification reduces the risk of a single point of failure. The likelihood of all chosen validators underperforming simultaneously is low, especially if you carefully research and select reliable validators.

To simplify the process, tools like stakeview, solanabeach, and stakewiz provide detailed metrics to help you compare and select validators effectively.

Check out the tutorial below to learn how to use stakewiz and stake with the Phantom wallet.

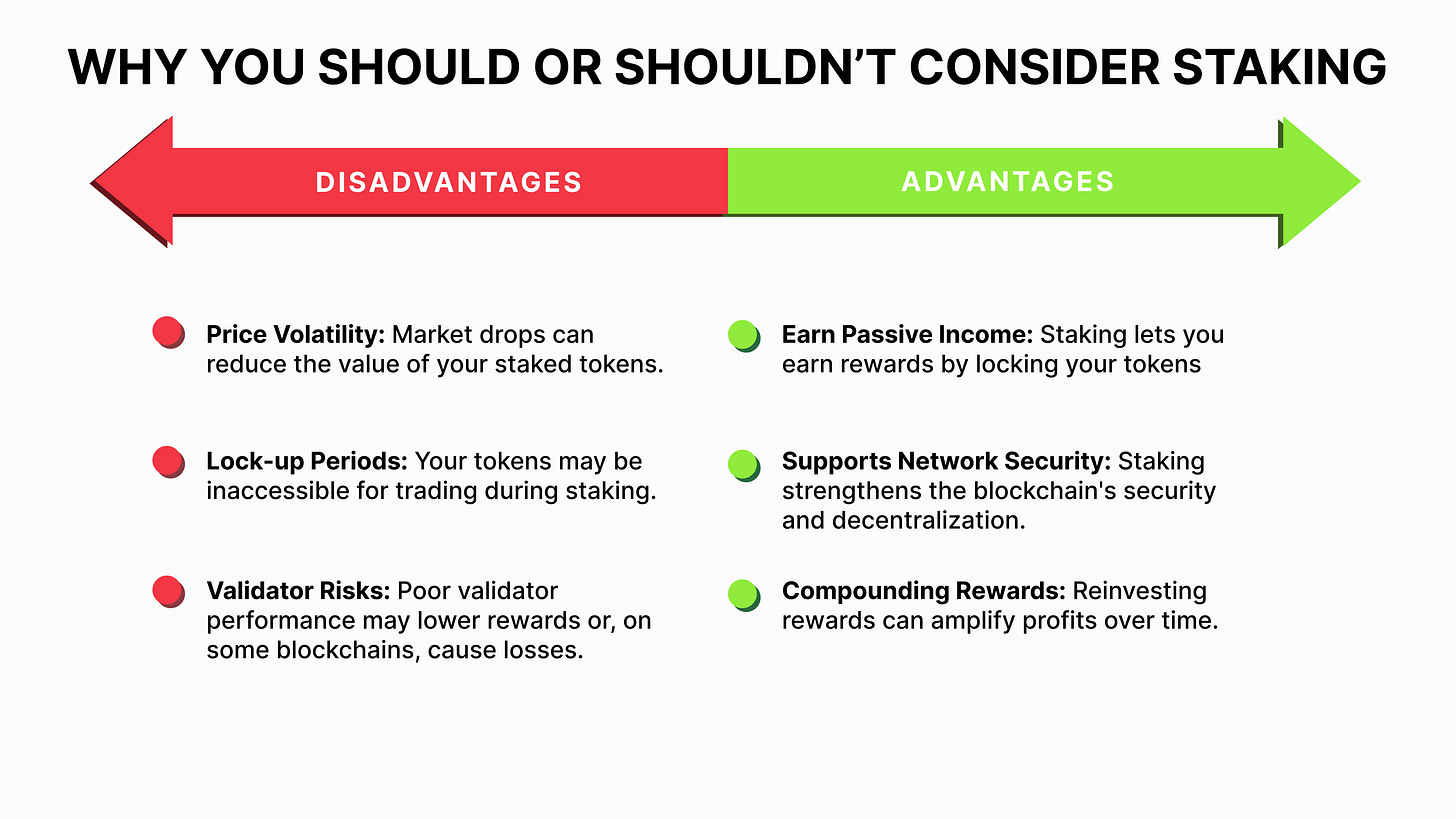

Advantages and Risks of Crypto Staking

Crypto staking offers several benefits that make it an attractive option for you. Here are why you should consider staking

Passive Income: One of the primary advantages of staking cryptocurrencies is the potential to earn a passive income just by locking your holdings for a certain period.

Network Security and Governance: By staking with trusted validators, you contribute to the network's security and stability. This is because validators use staked tokens to participate in the proof-of-stake consensus mechanism, ensuring the blockchain remains secure, decentralized, and operational.

Potential for Price Appreciation: By locking up your assets, you also reduce the number of tokens in circulation, making it easier for the asset price to grow.

Compounding Opportunities: Another benefit of staking is the potential to compound your rewards with stakes and boost your profits. This can lead to significant returns over time, making staking an attractive option for long-term investors

Risks Associated with Crypto Staking

While crypto staking offers several benefits, it's essential to consider the risks involved.

Price Volatility and Risk of Losses: Crypto markets can be unpredictable. Even with fixed rewards, your investment's value can drop if the market declines. Consider the underlying value and long-term growth potential of the asset before staking.

Lock-up Periods: Lock-up periods can be a significant disadvantage if market conditions change. During this period, you cannot sell or trade your assets. Note that Solana has a relatively short lock-up period (about 2-3 days) compared to other cryptocurrencies.

Validator Risks: If a validator fails or acts maliciously, it can impact your staking rewards. In some blockchains like Ethereum, this can also result in "slashing," where a portion of your staked capital is permanently lost. However, Solana's design protects your capital from being lost due to validator risks, although your rewards may still be affected.

Staking is more than just a financial strategy—it's a way to actively participate in the future of blockchain technology. As we've explored, validators and staking are crucial mechanisms that keep networks like Solana secure, efficient, and decentralized.

Before you dive in, take a moment to:

Assess your financial goals

Understand your risk tolerance

Start small and learn

Stay informed about Solana's evolving ecosystem

With careful planning and ongoing learning, you can make staking a rewarding part of your blockchain journey.

Thanks for reading, I would love to hear your thoughts in the comments, thank you! Feel free to connect with me on Telegram: @ayocode_s